cryptocurrency tax calculator ireland

Capital gains calculator ireland if you sell a property that is not your primary residence for more than you paid for it you will have a capital gain which is taxable. After some delay the Irish taxation service the Revenue Commissioners have finally issued guidance on how they see Cryptocurrency being taxed in Ireland.

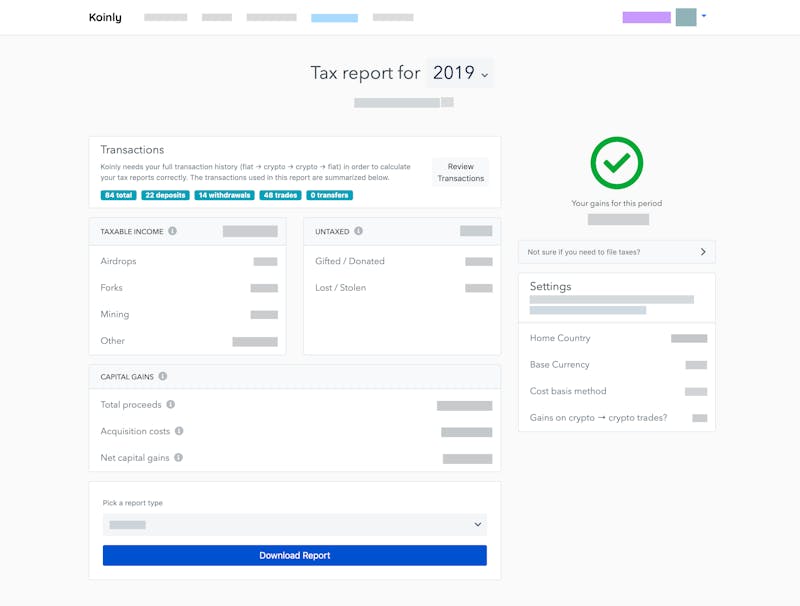

Cryptocurrency Tax Calculator For Ireland Revenue Commissioners Koinly

Coinpanda lets Irish citizens calculate their capital gains with ease.

. Tax and Duty Manual Part 02-01-03 5 131 Example 1 John sold crypto-assets for 5000 in 2021. Very low 025 fee falling to 01 with sufficient trading volume. Yes CryptoTaxCalculator is designed to generate accountant friendly tax reports.

Irish citizens have to report their capital gains from cryptocurrencies. This calculator only provides an indicative estimate based on data you have input and the tax brackets and rates found on. Capital gains tax CGT form.

Generate ready-to-file tax forms including tax reports for Forks Mining Staking. Heres an example of how to calculate the cost basis of your cryptocurrency. This means you can get your books up to date yourself allowing you to save significant time.

In this article we go over the main features of a cryptocurrency tax calculator. He had bought them for 4500. You simply import all your transaction history and export your report.

If you are an Irish citizen you will need to file your capital gains from crypto trading on a Capital Gains Tax form for both the Initial and Later periods. Irelands Revenue states that profits and losses of a non-incorporated business on cryptocurrency transactions must be reflected in their accounts and will be taxable on normal income tax rules. This means that profits from crypto transactions are subject to capital gains tax at.

PRSI PAYE and USC Will apply at the. Therefore no special tax rules for cryptocurrency transactions are required. Capital gains tax report.

Fortunately the first 1270 of your cumulative annual gains after deducting expenses and losses from other cryptocurrency investments further details below are exempt from tax. Divide the initial investment amount with the amount of crypto purchased lets assume 1000 coins. In addition to CSV import transactions can also be.

Bitcointax is the leading capital gains and income tax calculator for Bitcoin Ethereum Ripple and other digital currencies. In Ireland income tax on crypto activities typically involves getting Paid in Crypto accepting crypto for payment of goods and services airdrops signup referral. This means you can get your books up to date yourself allowing you to save significant time and reduce the bill charged by your accountant.

Your cryptocurrency tax rate on federal taxes will be the same as your capital gains tax rate. Take the initial investment amount lets assume it is 1000. You can discuss tax scenarios with your accountant.

Cryptocurrency Tax Calculator Alternatives. Where there is an underlying tax event on a transaction involving the use of a cryptocurrency there is a requirement in the tax code for a record to be kept of that transaction which will include any record in relation to the cryptocurrency. Use code BFCM25 for 25 off on your purchase.

Yes CryptoTaxCalculator is designed to generate accountant friendly tax reports. Therefore individuals that are trading in cryptocurrency are required to file an income tax return Form 11 or Form 12 each year and declare profits made on trading. June 4 2018.

You simply import all your transaction history and export your report. Direct tax treatment of cryptocurrencies. You pay 127 at 10 tax rate for the next 1270 of your capital gains.

Use our free cryptocurrency tax calculator below to estimate how much CGT Capital Gains Tax you need to pay on any cryptocurrency sales you made this financial year. That is the profits from trading will be taxable under Income Tax rules. If you are dealing in cryptocurrencies you need to make a declaration to Revenue even if you.

Using FIFO and the 4 weeks rule. Deposits can be made through bank transfer SEPA transfer international bank wire and now even credit cards. While cryptocurrencies are not legal tender in Ireland an investment in them is subject to taxation.

In Ireland crypto investments are treated just like investments in stocks or shares. Track your crypto portfolio development in real time and keep track of realized gainslosses. Automate your crypto tax calculation with the best Bitcoin tax calculator.

In Ireland cryptocurrency investments are subject to the same regulations as investments in stocks and shares. The deadline for filing CGT is at the end of this month. As a refresher short-term capital gains had a rate of 10 to 37 in 2021 while long-term capital gains had a rate of 0 to 20.

But any profit that you make above this figure will be taxed at 33 and you will need to file a tax return each year. The rate you pay on crypto taxes depends on your taxable income level and how long you have held the crypto. Thanks to the Blockpit cryptocurrency software you can find out if taxes are due on your trades.

One of the longest-running Bitcoin exchanges. See Taxation of cryptocurrency transactions for guidance on the tax treatment of various transactions involving cryptocurrencies. This is very helpful to everyone who has bought sold and held Cryptocurrency in the last 12 months in particular.

In other words if youre making profits or losses through the disposal of your cryptocurrency whether by selling gifting or exchanging you need to pay a 33 Capital Gains Tax CGT. There are no special tax rules for cryptocurrencies. Revenues view is that an investment in cryptocurrency is the same as a share investment and accordingly should be subject to Capital Gains Tax at 33.

The direct taxes are corporation tax income tax and capital gains tax. Back to homepage Back to top. As with any other activity the treatment of income received from charges made in connection with activities involving cryptocurrencies will depend on the activities and the parties involved.

Koinly helps you calculate your capital gains for both periods in accordance with Revenue Commissionerss guidelines ie. Capital gains tax is a tax on the profit when you dispose of an asset that has increased in value. The resulting number is your cost basis 10000 1000 10.

March 29 2018. This means that profits from crypto transactions are subject to capital gains tax at 33 at the time of disposal of the crypto. The profits will be subject to normal income tax rules ie.

In Ireland cryptocurrency investments are subject to the same regulations as investments in stocks and shares. 16 December 2021 Please rate how useful this page was to you Print this page. BitStamp is one of the worlds largest and most well-known Bitcoin exchanges.

Bitcoin Taxes has provided services to consumers and tax professionals since its launch in 2014. Coinpanda generates ready-to-file forms based on your trading activity in less than 20. If you dont want to use a tax calculator for whatever reason you have.

Made A Killing With Crypto In 2021 How To Calculate Your Tax Bill

Crypto Tax Calculator Cryptocurrency And Nft Tax Software Review

Crypto Tax Calculator Doing Your Crypto Taxes Has Never Been Easier Boinnex

Crypto Tax Calculator Review And Best Alternatives Crypto Listy

Cryptocurrency Bitcoin Tax Guide 2022 Edition Cointracker

Crypto Tax Calculator Review May 2022 Finder Com

Cryptocurrency Tax Calculator For Ireland Revenue Commissioners Koinly

Ireland Calculate And File Bitcoin Cryptocurrency Taxes Coinpanda

Find The Best Crypto Tax Software For Your Needs

Ireland Cryptocurrency Tax Guide 2021 Koinly

Cryptocurrency Tax Calculator For Ireland Revenue Commissioners Koinly

Uk Cryptocurrency Tax Guide Cointracker

Ireland Cryptocurrency Tax Guide 2021 Koinly

Ireland Cryptocurrency Tax Guide 2021 Koinly

Koinly Vs Zenledger Which Crypto Tax Calculator Is Better

Made A Killing With Crypto In 2021 How To Calculate Your Tax Bill

3 Steps To Calculate Binance Taxes 2022 Updated

Made A Killing With Crypto In 2021 How To Calculate Your Tax Bill